what is the property tax rate in dallas texas

This is currently the seventh-highest rate in the United States. Theres no personal income tax and theres no residential real estate transfer tax one of only 12 states in the country.

Which Texas Mega City Has Adopted The Highest Property Tax Rate

Real property tax on median home.

. In Texas a property owner over the age of 65 cant freeze all property taxes. Homes are appraised at the beginning of the year and appraisal review board hearings generally begin in May. 104 rows Dallas County is a county located in the US.

Real property tax on median home. However they do have the option of applying for a tax ceiling exemption which will freeze the amount of property taxes paid to the school district. Breaking this out in dollars if your home is valued at 200000 your personal property taxes at the average rate of 180 would be 3600 for the year.

There are a number of exemptions that help lower. 1 2020 tax rates and tax rate related information is reported to the comptroller on Form 50-886-a Tax Rate Submission Spreadsheet XLSX. Once market values are established Dallas along with other county public districts will establish tax levies alone.

Learn about Dallas metro property tax rates - Property tax rates for all major DFW metroplex citiestowns school districts and DFW metroplex counties. The average property tax rate in Texas is 180. Ad Get In-Depth Property Reports Info You May Not Find On Other Sites.

This freeze amount is based on the year the individual qualified for the 65 or older exemption and can. The Texas sales tax rate is currently. In this mainly budgetary undertaking county and local public administrators project annual expenditures.

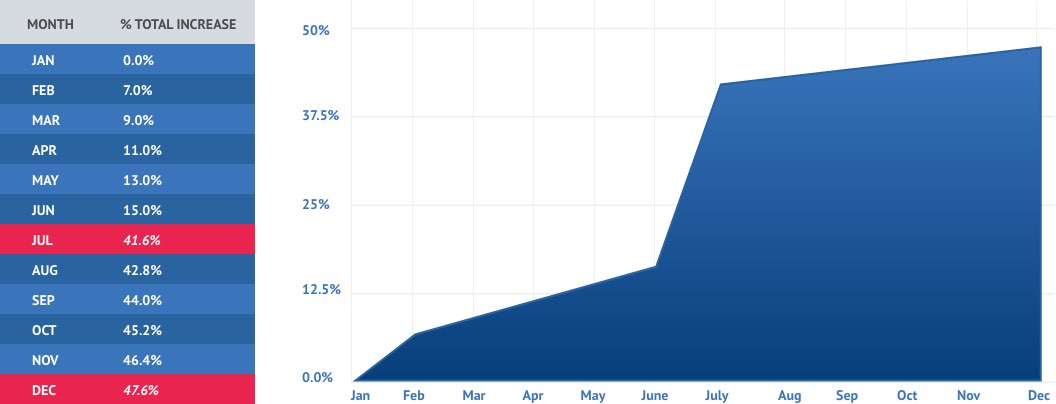

RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The median property tax on a 12970000 house is 282746 in Dallas County. Typically property tax rates do not change drastically year to year.

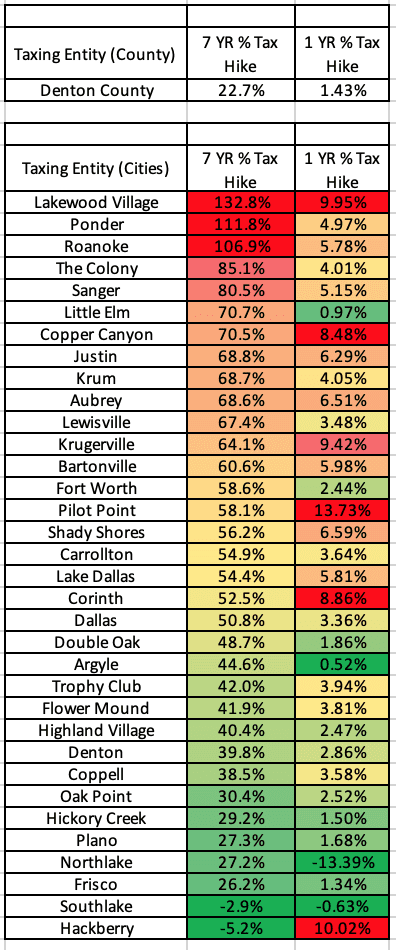

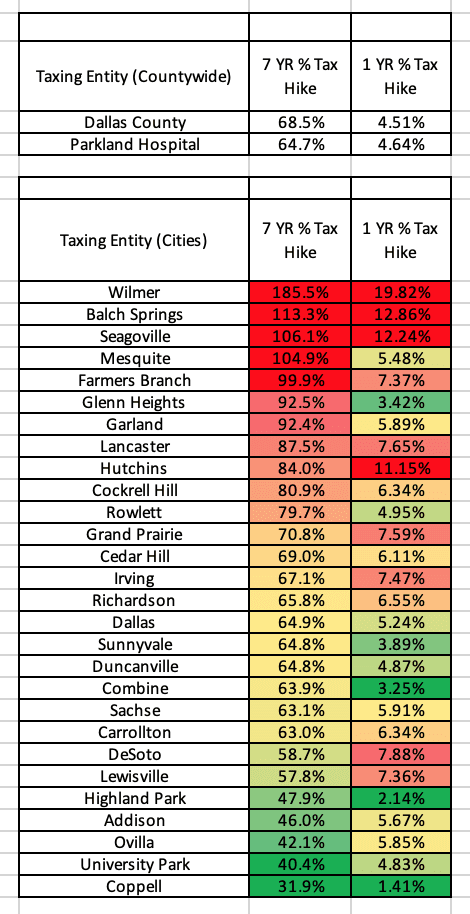

Texas citiestowns property tax rates. The minimum combined 2022 sales tax rate for Dallas Texas is. 10 percent of the appraised value of the property for last year.

A composite rate will produce counted on total tax revenues and also reflect your assessment total. RE trans fee on median home over 13 yrs Auto sales taxes amortized over 6 years Annual Vehicle Property Taxes on 25K Car. The median property tax also known as real estate tax in Dallas County is 282700 per year based on a median home value of 12970000 and a median effective property tax rate of 218 of property value.

Tax Code Section 2323 a sets a limit on the amount of annual increase to the appraised value of a residence homestead to not exceed the lesser of. Wayfair Inc affect Texas. Records Building 500 Elm Street Suite 3300 Dallas TX 75202.

What You Need to Know About Dallas Property Tax Rates. Learn all about Dallas County real estate tax. As of the 2010 census.

Search Valuable Data On A Property. Sales Tax State Local Sales Tax on Food. On top of that the state sales tax rate is 625.

The County sales tax rate is. Access to Market Value Tax Info Owners Mortgage Liens Even More Property Records. Ad Get In-Depth Property Tax Data In Minutes.

The following table provides 2017 the most common total combined property tax rates for 958 Texas cities and towns. Complete lists of Texas school districts and counties are shown by clicking on these Texas school districts property tax rates and Texas counties property tax rates jump links. This allows for a different tax rate for branch campuses in those school districts.

The market value of the property. Such As Deeds Liens Property Tax More. The median property tax on a 12970000 house is 234757 in Texas.

214 653-7811 Fax. Dallas County collects very high property taxes and is among the top 25 of counties in the United States ranked by property tax. This calculator can only provide you with a rough estimate of your tax liabilities based on the property.

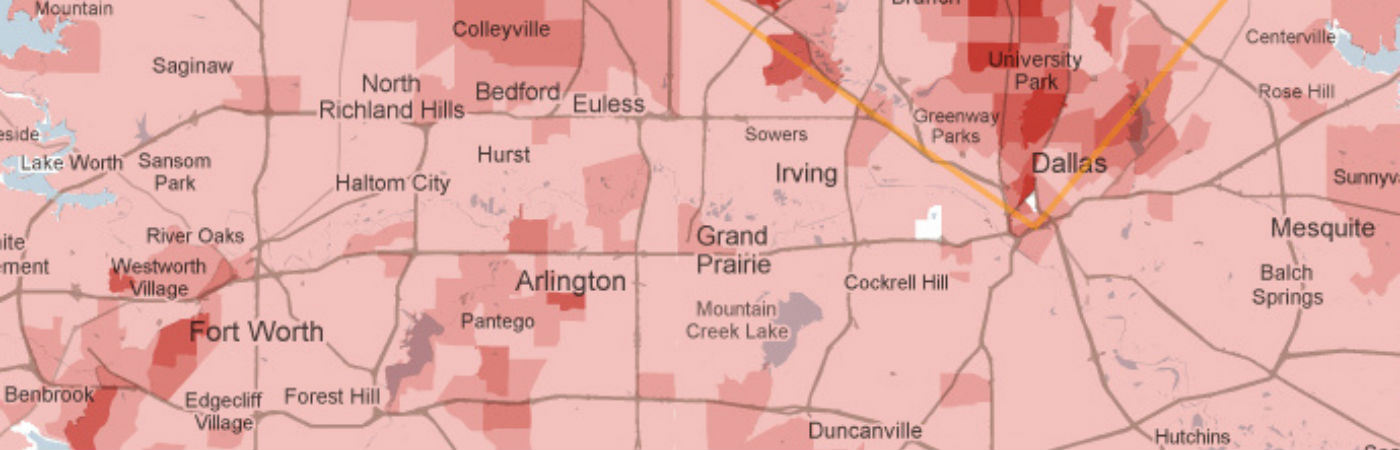

This rate includes any state county city and local sales taxes. But property values in certain areas are on the rise and as such so are property taxes. Did South Dakota v.

Sales Tax State Local Sales Tax on Food. This is the total of state county and city sales tax rates. Maintenance Operations MO and Interest Sinking Fund IS Tax Rates.

Whether you are already a resident or just considering moving to Dallas County to live or invest in real estate estimate local property tax rates and learn how real estate tax works. This is the case this year. While the national average tends to fall between 108 and 121 Texas average effective property tax rate is above 183.

There are no obvious changes in rates from 2020 to 2021. The latest sales tax rate for Dallas TX. The appraised value of the property for last year.

The median property tax on a 12970000 house is 136185 in the United States. When compared to other states Texas property taxes are significantly higher. Property taxes in Texas are calculated based on the county you live in.

In terms of taxes Texas is one of the best states you can live in. Start Your Homeowner Search Today. The market values taxable values and tax rates are reported to the comptroller by each appraisal district.

Texas Property Tax Exemptions. 2020 rates included for use while preparing your income tax deduction. The Dallas sales tax rate is.

According to the Tax Foundation that makes the overall state and local tax burden for.

If Dallas Property Tax Rates Are Going Down Why Are My Payments Going Up Mansion Global

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Property Taxes On Single Family Homes Rise Across U S In 2021 Attom

Austin Property Tax What Can You Expect When Moving Here Bhgre Homecity

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Comparing Lowest Property Taxes Of Dallas Fort Worth Homes Can Be Confusing Misleading

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Property Tax Penalty Chart Texas Property Tax Penalties And Interest Chart Tax Ease

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

What The Bleep Is Going On With Texas Property Taxes Texas Monthly

Tax Rates Richardson Economic Development Partnership

Texas Property Tax Rates Cantrell Mcculloch Inc Property Tax Advisors

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard

Why Are Texas Property Taxes So High Home Tax Solutions

2021 2022 Tax Information Euless Tx

What You Should Know About Dfw Suburb Property Taxes 2021 Nail Key

Homeowners Wallets Still Hit By City And County Property Tax Growth Texas Scorecard